-

9 October 2018

Caring for mental health wellbeing

In many ways, mental health is just like physical health: everybody has it, we need to take care of it and should we suffer a mental health issue, it’s all too often compounded by a financial health impact...

Read more

-

26 September 2018

Our wider duty as financial protection providers

Financial protection solutions such as life insurance, critical illness insurance and income protection are designed to, and do, provide essential financial assistance should illness or death occur...

Read more

-

20 September 2018

Supporting you to meet Insurance Distribution Directive requirements

As the introduction of the Insurance Distribution Directive is fast approaching, I want to discuss in more detail what’s involved and the support available from Scottish Widows...

Read more

-

11 September 2018

Financial resilience to income shocks

The August Bank of England interest rate rise was a shot across the bow – a reminder that ultra-low rates are not the norm. While the move is unlikely to be the start of a huge or rapid rise in the cost of borrowing...

Read more

-

9 July 2018

Helping people when they need it most - how our industry has moved on

Our industry has come a long way from the first claim on a “modern” insurance policy, following the death of salt merchant William Gibbons in London in 1584...

Read more

-

4 May 2018

Self-employed, financial self-reliance & intersecting needs

There is a rapidly growing number of people in the UK who are self-employed and largely self-reliant. Office for National Statistics (ONS) data has recently confirmed this is now exceeding 4.7m people and around 14.7% of the workforce...

Read more

-

17 April 2018

Access to Insurance

At a recent Insuring Women’s Futures Programme meeting, one of the speakers quoted the CII Charter and shared what for me is a key objective for all insurance professionals and especially financial protection specialists...

Read more

-

27 March 2018

Mortgage welfare reform and the need for a protection 'Plan B'

Next month marks another step in what has been the biggest, most sustained change to the welfare state since the time of Beveridge. On April 6th 2018 the main state benefit for UK mortgage holders, Support for Mortgage Interest (SMI), changes...

Read more

-

2 March 2018

Getting to the heart of Critical Illness cover - a promise fulfilled

I recently hosted an event that marked the culmination of an important promise. At the BAFTA auditorium in London, our Protection team arranged the premiere screening of "Change of Heart: The operation that changed the world"...

Read more

-

31 January 2018

My New Year's resolutions

The end of January is often when New Year's resolutions are broken, with abandoned diet plans and gym memberships going unused. But this is also a good time to think about what we want to achieve professionally in 2018...

Read more

-

20 December 2017

Bereavement benefits changes and the need for protection

As bereavement benefits change, the need for family protection is more important than ever...

Read more

-

1 December 2017

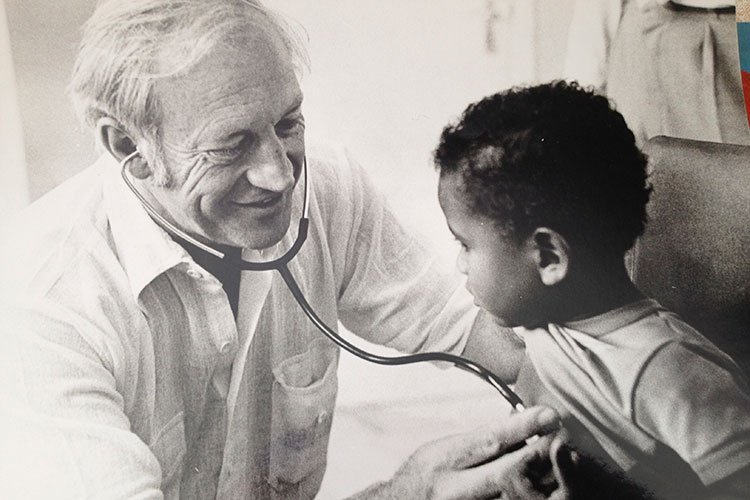

How the first heart transplant led to critical illness cover

Fifty years ago – in the early hours of Sunday, December 3rd 1967 – the world’s first human heart transplant was carried out in Groote Schuur Hospital, Cape Town, South Africa by a pioneering medical team led by Professor Christiaan Barnard...

Read more

-

15 November 2017

Insuring Women's Futures

Whilst the UK’s gender pay gap is increasingly and rightly attracting media attention, recent ONS gender employment data makes for interesting reading...

Read more

-

6 November 2017

Critical illness cover, paying the claim, providing the care.

The 3rd of December marks the 50th anniversary of the world’s first human to human heart transplant. What people may not know is that this medical advance was to be the catalyst for the development of critical illness insurance…

Read more

-

2 October 2017

Time to start the protection conversation

Welcome to my blog where I aim to share all things protection with you, highlighting and discussing issues that impact on consumer need for improved financial resilience and access to appropriate protection advice, solutions support services and rehab...

Read more